Gold has been the most commonly used means of exchange throughout history, from the earliest civilizations to the present. Moreover, due to its growth potential, gold investing is extremely appealing, especially in uncertain economic times. It is a valued asset due to its widespread acceptance and use as a store of value.

We will delve into the strategies used to make smart choices as we explore gold investments. You can position yourself to take advantage and possibly maximize your profits in the appealing world of gold investing by keeping up with the market trends and the gold rate today, which is approximately between 60 thousand and 65 thousand for 24 carats.

Key Factors to Consider Before Investing in Gold

Consider important considerations that may affect your financial decisions before investing in gold. You can make decisions that are in line with your financial goals and risk tolerance by carefully weighing these considerations.

You may find the following considerations useful in making an informed decision:

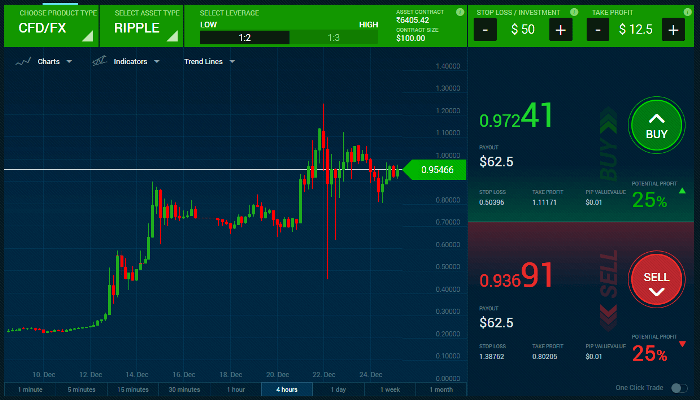

Market Trends and Analysis

For every wise gold investor, keeping up with current market trends and carefully analyzing gold prices are essential habits. The constantly changing nature of the financial markets emphasizes how crucial it is to stay informed so that you can make wise judgments in a field where information truly is power.

Risk Tolerance and Goals

Starting your gold investment journey requires a thorough examination of your risk tolerance and financial goals. This important work creates a structure for adjusting your investment strategy to fit your particular situation.

Diversification Strategy

It's vital to carefully consider how gold fits inside the bigger picture when developing an investment plan for your investment assets. The addition of gold can be crucial in reducing risk and improving overall stability, particularly during times of market uncertainty.

Form of Investment

There are two main types of gold investments you may make: paper gold (ETFs and futures) and real gold (bars and coins). Each option has particular benefits and things to think about that might have a big impact on how you invest. As a result, your decision between paper and actual gold should be based on your investing objectives.

Costs and Fees

It's crucial to take into account the whole range of expenses and fees that can affect your venture's overall profitability when deciding to invest in gold. These monetary factors are crucial in forming your investing plan and eventually deciding the profits you earn.

Final Words

Adding gold to your investments might be a great strategy for choosing it and protecting against fluctuations in the market. Furthermore, gold investment might be a wise choice for those wishing to secure their assets over the long term and hedge against inflation, even if no investment is completely risk-free.

Remember that when investing, making informed choices and being informed about the gold rate today is crucial. In this case, 5paisa can be useful in this situation. They can help you decide how to invest in gold in the most advantageous ways. It's similar to having a helpful guide to show you the way to success. You can therefore make your money expand using gold and 5paisa together, exactly like a golden chance!