Pension planning is a multifaceted, time-consuming procedure. You need to have the financial cushion to finance it all, in order to live a happy, safe and fun retirement. The fun part is why the important and possibly dull portion should be given attention: how to arrange it.

Retirement planning begins with thinking about your pension objectives and how long you have to achieve them. You then need to look at the kind of pension accounts you may collect to support your future.

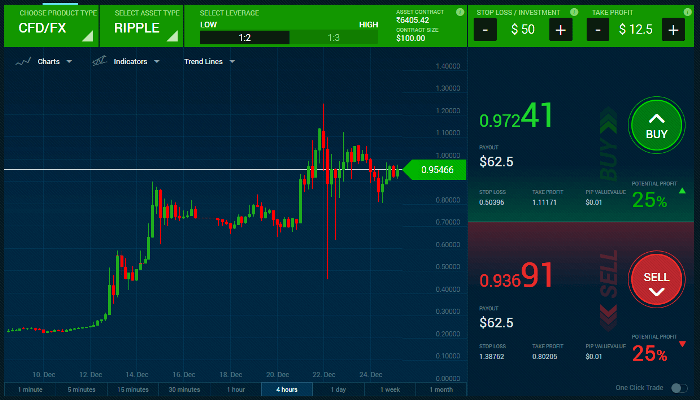

With private investment management financial institutions can help you invest and save for your future.

There are strategies to reduce the pension tax impact while saving for the future and to keep on with the procedure when that day comes and you are retiring.

Assess your Time for Saving

Your present pension age and your anticipated retirement age provide the foundation for an efficient pension strategy. The longer the period from today to retirement, the greater your portfolio's risk.

You should have most of your assets in riskiest investments, such as equities, when you are young and 30 years of age until retirement.

Despite volatility, other assets, such as bonds, have traditionally surpassed stocks for a long time. The important term is 'long,' that is over 10 years at least.

In order to retain your purchasing power throughout retirement, you also need revenues

to outdo inflation. “ It's like an acorn for inflation. It begins tiny, but may become a powerful oak tree given sufficient time. We've all heard — and we want— our money's compound growth.

Determine Your Spending Need

Real expectations regarding retirement spending practises enable you to establish the retirement portfolio's needed size. Many think that their yearly expenditure after retirement will be just 70 to 80% of what they previously spent.

This assumption is frequently proven incorrect, particularly when mortgage is not paid or medical expenditure has not been anticipated. Sometimes retirees are spending their first several years travelling or other ambitions in the bucket list.

Since retirees no longer work 8 or more hours a day, they have more time for travel, tour, shop and other costly hobbies. Precise retirement spending objectives aid the planning process, as greater expenditure is needed nowadays.

Your withdrawal rate is one of the - if not the biggest - influence in the lifetime of your pension fund. It is very important to have an accurate evaluation of what your retirement expenditures will be since they will impact how much your account you remove every year and how you invest it.

Assess Risk Tolerance

Either you or a professional money manager who is responsible for investment decisions, the most crucial step to retirement planning is a correct portfolio allocation that balances risk aversion and return targets.

How much risk are you prepared to take to achieve your goals? Should some revenue be put aside for necessary expenditures in risk-free treasury bonds?

You need to ensure that the risks in your portfolio are comfortable and you know what is needed and a luxury. This should not only be spoken to your financial adviser but also to your family members seriously.

Bottom Line

The responsibility of pension planning today falls more than ever on individuals. Few workers, particularly in the private sector, can depend on a defined pension given by their employers. To avoid any uncertainties you can contact Mashreq bank to get a saving plan. Mashreq bank offers best private banking services in the town.

Rank your article to top by submitting Tech News Write for Us category blog at Business Glimpse.

Do Investment Write For Us if you have useful knowledge on the subject.